Welcome to the next post in our brand new series called the Investor Challenge. Today we’re kicking things off with a really interesting case study: Turning around a 4-unit multifamily property in Danbury, Connecticut.

This place had some big problems – tenants who weren’t paying rent and apartments that were falling apart from deferred maintenance. But the out-of-state owner didn’t want to give up just yet. He hired us to help turn his property around.

Our goal? Get rid of tenants who weren’t paying, address the dilapidated apartments, find better tenants, and increase existing rents to market rate in just six months. This wasn’t just about making the building look nice again; it was about transforming this owner’s asset from depreciating to appreciating.

Come along with us as we tell the story of how we transformed this property. We’ll take you through everything, from the first steps to the exciting finish. You’ll get to see the smart moves we made, the tough spots we got through, and what we learned along the way.

If you own Connecticut real estate and want to make the most of your properties, especially the ones with seemingly endless problems, you’re going to find some good tips here.

The Problem

1. Non-Paying Tenants

The most pressing issue was the non-paying tenants occupying two of the four units. Not only were they months behind on rent, but their continued presence was also a financial drain on the property, affecting its overall profitability. In addition, less income translates to less maintenance done.

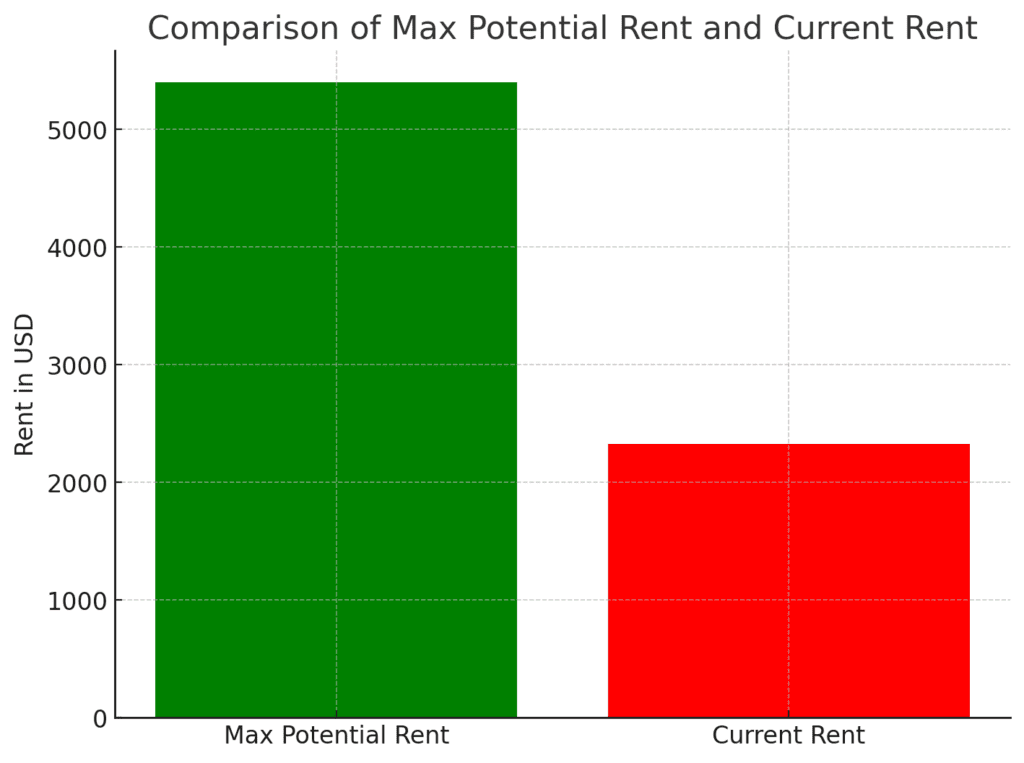

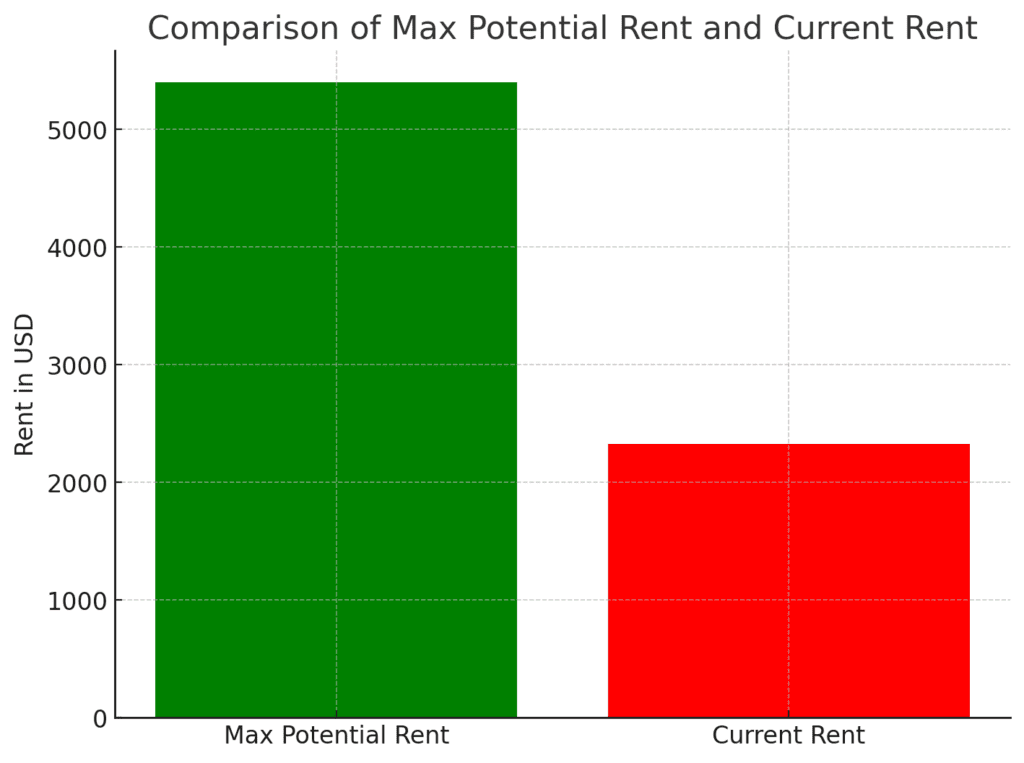

Delinquency and loss to lease sucked away 55% of this owner’s maximum potential income every month!

2. Water Leaks and Structural Deterioration

Upon inspection, we discovered significant water leaks in the ceilings of multiple units. These leaks had led to not just unsightly stains but also structural concerns that demanded urgent repairs to prevent further damage.

3. Absence of Effective Property Management

It was evident that the property had suffered from a lack of professional property management. There were no systems in place for regular maintenance checks, tenant communications, or financial management, contributing to the property’s chaotic decline.

4. Pest Infestations

Several tenants complained about pest infestations, including rodents and cockroaches. Besides the health hazard, this also indicated long-term neglect in regular property upkeep.

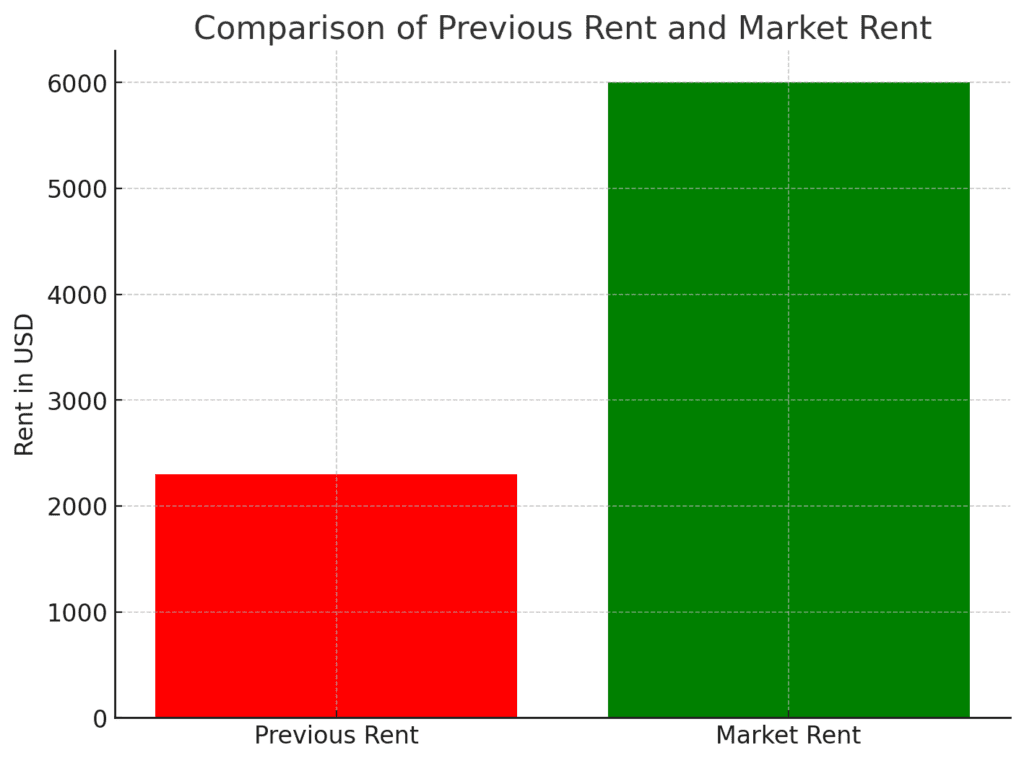

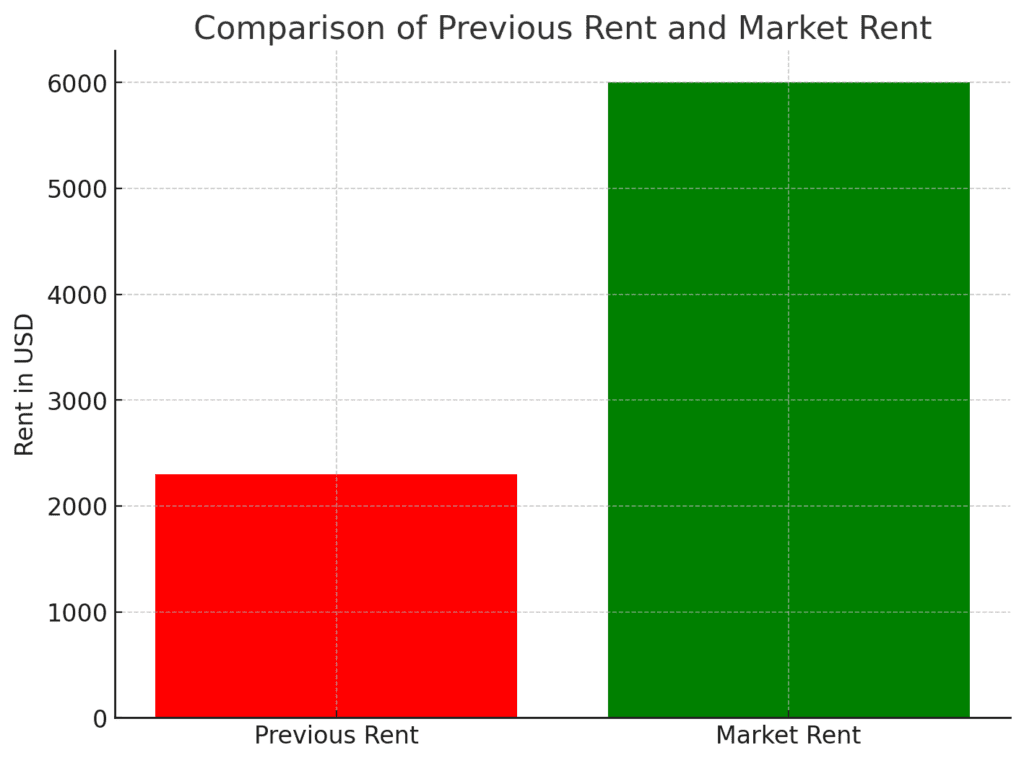

5. Artificially Low Rents

The rents for the units had not been raised in years, resulting in rates significantly below the market average for Danbury. This was a direct consequence of the property’s deteriorating condition and the owner’s hesitation to invest in improvements without a trusted team on the ground.

6. Broken Windows and General Disrepair

The property’s external appearance was just as neglected as its interior. Broken windows were a common sight, and the lack of proper care had left the building looking rundown and uninviting.

7. Neglected Lawn Care

The outdoor spaces, including the lawn and common areas, were unkept. Overgrown grass, untrimmed hedges, and accumulated debris contributed to the property’s overall dismal appearance.

8. Non-Functional Appliances

Inside the units, the appliances were outdated and, in many cases, non-functional. This not only made the units less appealing to potential renters but also reflected the lack of investment in maintaining the property’s value.

Each of these issues contributed to the property’s underperformance. Our goal was not just to fix these problems but to transform this property into a desirable, profitable investment. The following sections will detail our strategic approach to this transformation and the challenges we faced along the way.

Our Property Makeover Strategy

After we figured out all the problems with the Danbury property, it was time to plan. This plan wasn’t just about quick fixes; it was about making sure the property would be successful and make money long-term. Here’s how we planned to do it:

1. Handling the Non-Paying Tenants

First things first, we had to deal with the tenants who weren’t paying rent. We followed all legal procedures to evict them, making sure it was done right. We also began advertising the units at the same time to line up new and better-screened tenants.

2. Fixing the Physical Damage

The water leaks and broken windows needed urgent repairs. Our workers fixed these issues quickly. Our goal was to not only repair but also upgrade these units to make them more appealing.

3. Establishing Proper Management

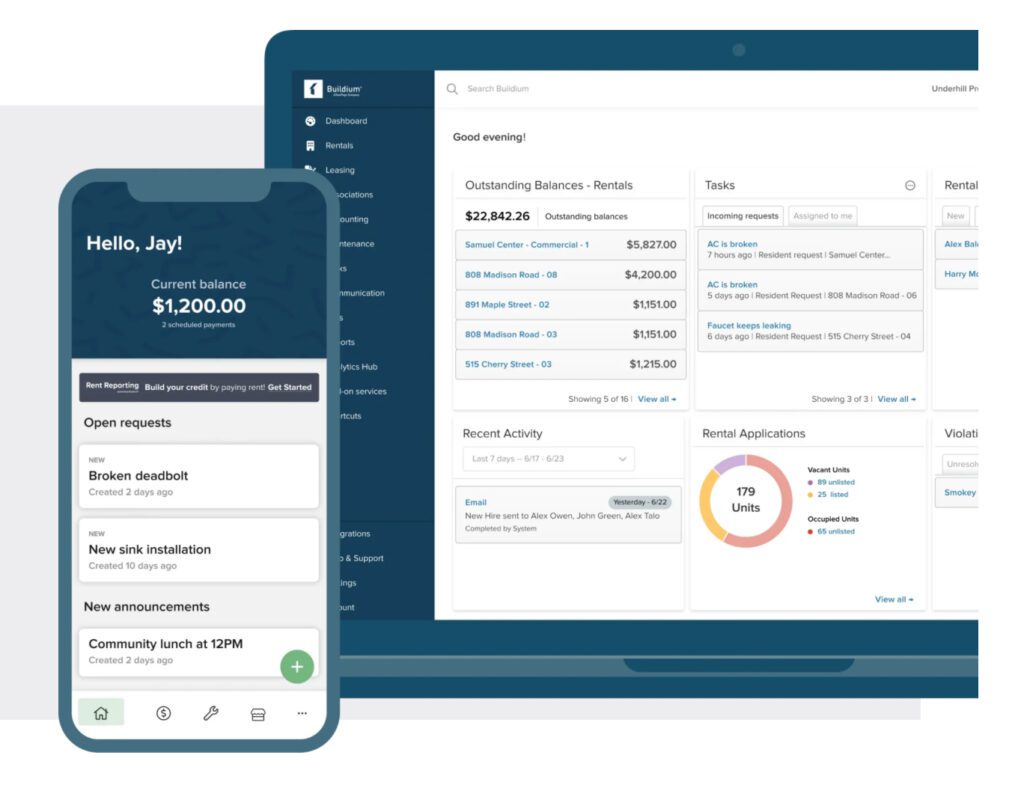

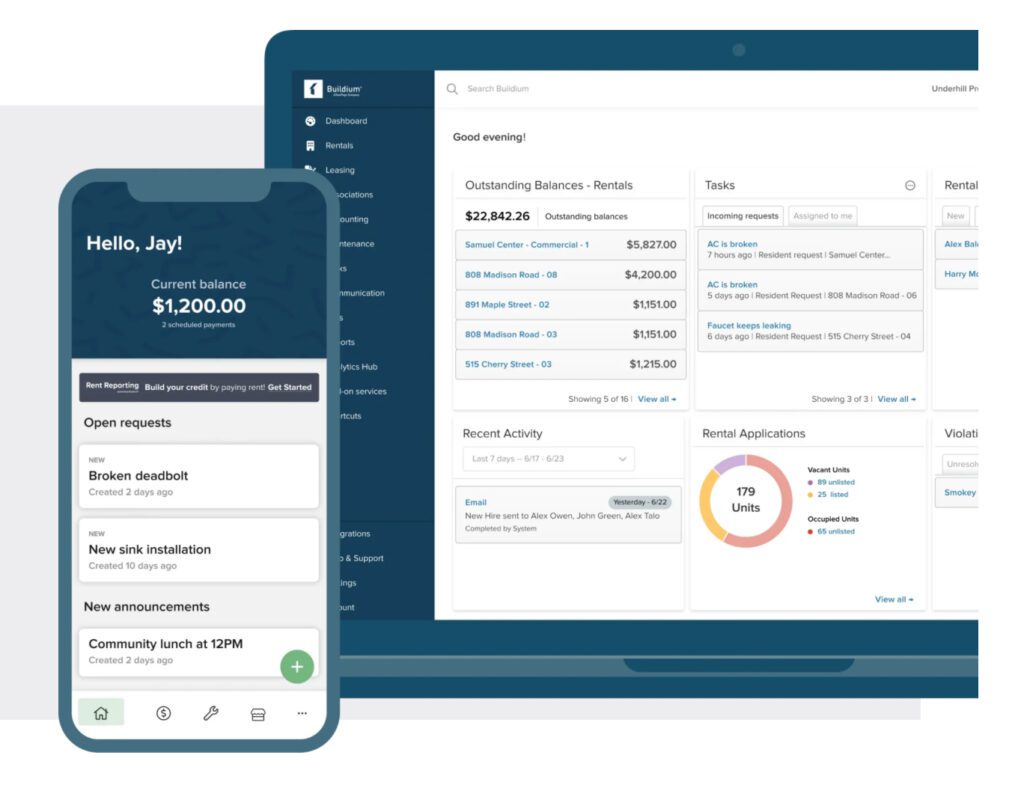

To avoid future problems, we implemented our property management system. This included regular maintenance checks, tenant maintenance service systems, and our online portal and app for owners to track property performance. All data related to the property was in one place for realtime access at any time. We also engaged in regular strategy coaching and project update calls with the owner.

4. Tackling the Pest Problem

We knew we had to get rid of the pests to make the apartments livable. We hired a professional pest control service to treat the entire property and planned regular treatments to keep the pests away for good. Rodent entry points were sealed and clutter was removed to minimize pest return.

5. Raising the Rents

After fixing up the units, we could now increase the rents. We did market research to find out the right rent prices that were fair, would rent quickly, but also would make the property more profitable. We were able to go up from $1200 to $1500 per month per unit.

Since only two out of the four units were paying consistently, with the vacancy and loss to lease closed, we won a 160% rental income increase for this owner.

6. Beautifying the Property

We tidied the outside of the property too. This meant repairing the windows, taking care of the lawn and gardens, and generally making the place look welcoming.

7. Updating the Appliances

To make the apartments more attractive to good tenants, we decided to replace old, broken appliances with new ones. This would not only make the tenants happy but also add value to the property.

Our plan was ambitious, but we were determined to make this property a success. By tackling each issue step by step, we transformed this struggling property into a profitable asset within six months.

Results and Reflection

After six months of hard work and overcoming many challenges, we finally reached the end of our project at the Danbury property. Here’s a look at the results and what we learned from this experience:

The Final Outcome

- Tenant Situation: We successfully replaced the non-paying tenants with reliable ones who were happy to live in the improved units. This not only stabilized the rental income but also created a better community atmosphere in the building.

- Physical Improvements: The water leaks were fixed, new windows were installed, and the electrical and plumbing systems were updated. The property looked fresh and well-maintained, both inside and out.

- Pest-Free Environment: After multiple treatments and educating tenants on prevention, the pest issue was finally resolved. This made the living conditions healthier and more comfortable.

Financial Improvements

- Increased Rent: With the renovations and improvements, we were able to raise the rents from $1200 to $1500, matching the current market rate. This significantly boosted the property’s income.

- Cost Management: Despite some unexpected expenses, we managed to stay within our overall budget by utilizing our maintenance insurance, home warranty plans and prioritizing essential repairs and upgrades.

Tenant Satisfaction

- Positive Feedback: The tenants appreciated the upgrades and the efforts to improve their living conditions. They were particularly happy with the new appliances and the cleaner, well-kept outdoor spaces.

- Reduced Complaints: With the improvements and regular maintenance, tenant complaints dropped significantly. This also made property management smoother and more efficient.

Lessons Learned

- Importance of Planning: We learned that having a flexible yet detailed plan is crucial, especially when unexpected issues arise.

- Communication is Key: Regular communication with tenants and team members helped in managing expectations and addressing concerns promptly.

- Focus on Long-Term Value: Investing in quality repairs and improvements pays off by increasing the property’s value and attracting good tenants.

Ecstatic Reviews from the Owner

The owner expressed their satisfaction with the transformation. They were impressed by the increase in income and the overall turnaround of the property. This project not only restored their confidence in their investment but also taught them the value of professional property management.

This journey was a testament to how dedication, strategic planning, and effective management can turn a struggling property into a thriving investment. It was a challenging but ultimately rewarding experience that demonstrated the potential of even the most underperforming properties.

Achievements and Impact

- Financial Turnaround: The most significant result was the financial improvement. By addressing the issues, renovating the units, and updating the rent prices, we significantly increased the property’s income. For an investor, seeing a struggling property become a profitable asset is incredibly rewarding.

- Property Value Increase: The physical improvements not only made the property more appealing to tenants but also increased its overall market value. This is crucial for investors looking at the long-term gains of their real estate portfolio.

- Stable Tenant Base: Replacing non-paying tenants with reliable ones and improving the living conditions led to a more stable tenant base. This reduces turnover rates and ensures a steady rental income, a key goal for any property investor.

Key Takeaways for Out-of-State Investors

- The Need for Local Insights: Understanding the local market, including tenant expectations and rental standards, is vital. Out-of-state investors should seek local expertise or work with property management firms that have in-depth knowledge of the area.

- Effective Communication and Management: Regular updates and clear communication are essential, especially when you can’t be physically present. Utilize technology to stay informed and involved in the management process.

- Flexibility and Contingency Planning: Always be prepared for unexpected challenges. Having a flexible approach and a contingency budget can help navigate unforeseen issues without major disruptions.

- The Importance of Professional Management: This project highlighted how professional property management can transform a property. It’s worth investing in experienced managers, especially when managing properties from afar.

This project at the Danbury property was more than just a renovation; it was a comprehensive overhaul that showcased the transformative power of effective property management.

For the out-of-state investor, the journey was eye-opening, demonstrating that with the right team, strategy, and execution, even the most challenging properties can become valuable assets.

The success of this project serves as a powerful example and learning experience for investors, emphasizing the importance of strategic planning, local expertise, and professional management in achieving real estate success.